Domain Appraisal

Understanding Domain Appraisal: How much is your domain worth?

Understanding domain appraisal is important because domain names are a crucial aspect of almost any type of endeavor. A domain name can help define a business; it can be synonym for people looking for a particular niche. Using the right word or phrase to describe a venture is, in many ways, an art form in itself. It requires in-depth knowledge and vision of what it is you’re trying to achieve with it. For this reason, certain domain names can become very valuable.

Domain appraisal basically refers to how much a domain is worth. The value of a domain will ultimately be determined by how much others are willing to pay for it. However, there are a number of traits that will usually help determine if a domain name is valuable. These include its length (shorter names are usually preferred), language, extension (.com tend to be the most sought after), and other factors.

If you own a domain that you think may be valuable to others, it can be challenging determining its retail price. Certain companies will pay up to six-figure amounts to acquire a domain name that suits their business profile, so how can we determine the appropriate value of a domain?

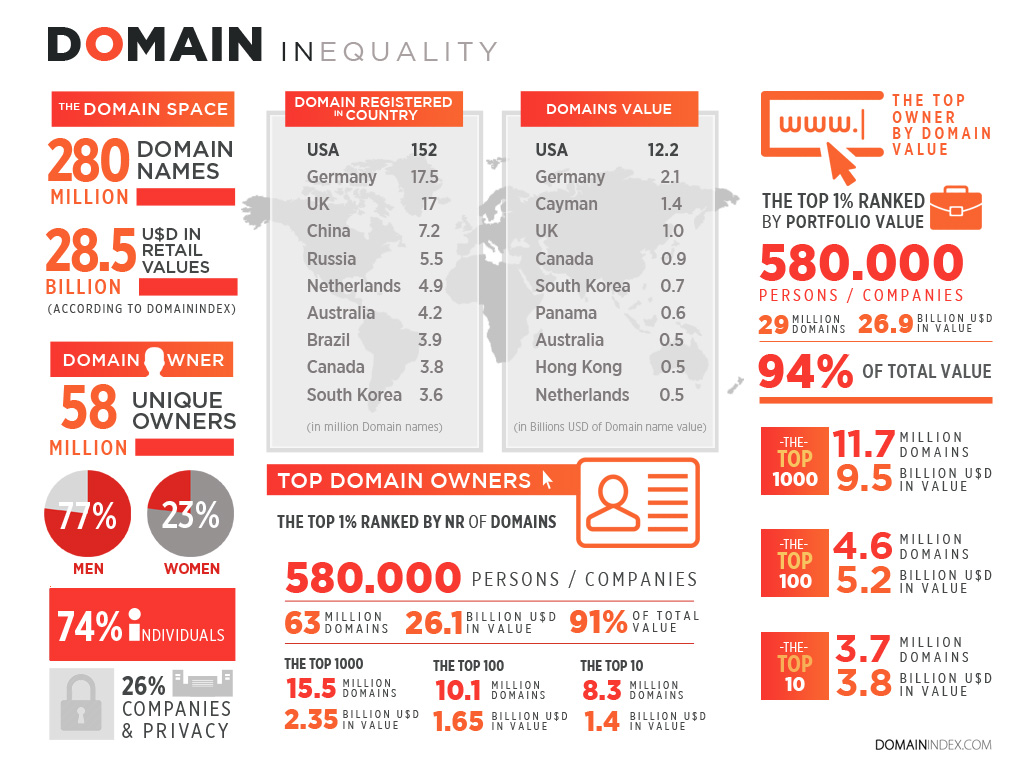

A common way to do this is through domain appraisal services; a popular site is Domainindex.com. The site allows users to submit domain names, providing an estimate of how much the domain may be worth. Domainindex.com is a free of charge service that uses algorithms to determine a domain’s Alexa rank, keywords, number of searches, and various other characteristics that help evaluate the domain’s financial worth. The site also includes numerous tools for domainers and webmasters, as well as information on the domain market. Domainindex.com also allows users to search for mass appraisals of domains with over 100 TLDs.

As mentioned earlier, the .com extensions are often preferred and tend to be the most valuable domains. Regional TLDs such as .uk or .ca may also become sought after, but nevertheless the number of potential buyers will be significantly limited. Short domains are also considered valuable. Usually, the shorter the domain name, the most valuable it will be. Effective and to-the-point keywords can also be a strong factor in determining the value of a domain name. A domain titled “organicfoods.com” would likely be preferred over “organicproduceandmeats.com”.

Ultimately, you need to understand how your potential buyers think in order to understand your domain’s value. You need to understand their field, their market, their potential buyers and audiences. Finally, knowing how much related domains are priced at will help you determine your domain appraisal value.

Domain Inequality

Will ICANN change the internet forever by using Bitcoin algorithms?

by Benjamin Guttmann, author of "the Bitcoin Bible"

Many domainers are big bitcoin fans, looks like even ICANN is now in the Bitcoin fever.

In a draft ICANN Report released late last month, the organization spokeof algorithms like Bitcoin and the future ofan Internet not controlled by the US Government. This could mean that theorganization is exploring the possibility of a global multi-stakeholder accountability process instead of thecurrent situation of the United States Government in the Internet’s uniqueidentifier system, meaning the US Government would relinquish their remainingcontrol of the Internet, and transfer important technical functions of theInternet to the global Internet community.

Presently, the government’s current responsibilities include the role ofadministering changes to the Domain Name System’s (DNS) root zone file, whichis the database of top-level domains (.edu, .gov, .mil). Additionally, the USGovernment also oversees the historic data regarding unique identifierregistries for Domain names, IP addresses and protocol parameters.

The solution might be to use similar protocols as in the encryption of Bitcoin transactionsand the idea of an undependable “blockchain”.

This would transfer all power to the users.

from the ICANN draft:

“Is there a technical way to think aboutsharing control over the root? Some theories have been advanced. One school ofthought is that data should have N multiple signatures. And thenM/N, signatures are required to authenticate the data. Of course there arearguments about M and N, and whether different crypto is needed/desirable.

It’s not our intention to argue for aspecific system here, but we do feel that a good design could allow thepolitical process of deciding how control should be shared to start. Our visionis the creation of a toolbox for shared zone control, not only for the root,but also for other zone coordination problems.

We note that the DNS Operations (DNSOPS)working group in the IETF has two proposals for coordinating DNSSEC signinginformation, but wonder if it might be better to create a general facilityrather than a solution to this point problem. Coordination of forward andreverse addresses might be another application.

The participants could then each do astandard algorithm to generate consistent state. This might seem like afantasy, but Byzantine algorithms like Bitcoin [Andreesen 2014] and Namecoinshow that such systems are possible today.

(Note that we aren’t proposing the rules,just a distributed system for implementing whatever rules the community wants.)”

More about this at ICANN

Heritage 2nd Auction: List of domains appraised

So are new gTLD´s a success ? or not ?

However this is not really the numbers to compare I think, what we need to look at at is something else:

How many new gTLD´s have been registered compared to the affected .com domains.

So these are the numbers to watch in my opinion:

55.000 Domains contain "guru"

80.000 Domains contain "holding" or "holdings"

90.000 Domains contain "ventures"

65.000 Domains contain "plumbing"

45.000 Domains contain "singles" or "single"

75.000 Domains contain "bike" or "bikes"

115.000 Domains contain "clothing" or "clothes"

(in any extension that must be paid for)

So this gives us a total of 525.000 Domains that contain the keywords launched in the last days as TLD´s.

I think here we start to compare apples with apples because the 7 new extensions are indeed generic but only in a very limited area of keywords.

So purely based on domain numbers they did reach about 5% of what all other extensions did over 25 years in one day

Based on revenue it looks even better, the average customer pays about 12 USD/year for all other extensions on average, while my guess is the average customer pays 45 USD for a new gTLD.

This means:

900.000 USD for new gTLDs / year

6.5 Mio USD for all other extensions /year

this is a market share of about 12% after one day.

I find the number of 20.000 registrations for the start of 7 new extensions relatively low, however I must say the process has been managed extremely bad in my opinion by registrars, in fact only Godaddy was able to make this a good experience for the user, many other registrars have not even been able to let one register new gTLD´s.

We will have another look at the numbers in a month, then we will know more.

Heritage Auction Domain Names appraised

dupontcircle.com 18.400

ojx.com 5.500

coincompany.com 1.510

doctoratedegree.com 21.500

chicagowine.com 1.990

animation.com 270.000

kcy.com 6500

fxtrading.com 25.000

sellshort.com 8.870

dayton.com 120.000

coins.ca 20.000

comics.ca 25.000

aie.com 16.100

zqf.com 3.800

equalrights.com 8.090

dvds.com 3.000

commercialart.com 4.690

burbank.net 8.000

ffq.com 3.750

numismatics.com 20.000

charge.me 5.000

businessphones.com 41.700

aku.com 38.600

sociology.com 60.000

sellgoldcoins.com 6.500

kfx.com 8.174

marilyn.com 32.000

nl.com 550.000

exercisegloves.com 3.300

keynesian.com 30.000

cakemix.com 7.500

numismaticsblog.com 500

mutualfunds.com 1.750.000

giu.com 4.500

bulkdiapers.com 4.500

hemisphere.com 12.600

alexandria.com 240.000

downline.com 6.700

activestocks.com 1.910

thecoinblog.com 500

bicycle.com 380.000

hjr.com 14.700

footballuniforms.com 8.310

suit.com 112.000

ojq.com 4.840

gradedcards.com 2.550

basketballmemorabilia.com 2.000

vjz.com 4.500

smarttvs.com 1.010

golflessons.com 71.500

jazzblog.com 4.000

mycoincollection.com 1.300

tie.com 120.000

uncutdiamonds.com 7.940

qr.com 172.000

newtees.com 988

woj.com 7.500

footballequipment.com 9.780

italiansuits.com 9.500

luxurybags.com 8.660

kcj.com 9.300

swisschronograph.com 1.040

swisschronographs.com 1.070

px.net 6.300

currencyexchange.com 575.000

divesuits.com 3.770

opalearrings.com 3.100

xz.com 110.000

phq.com 8.650

we hope this is helpful for you, if you disagree please comment, we will take a closer look if necessary.

What we learned from .ORG about new gTLD´s

Since everybody iscurrently trying to figure out if new TLD´s will be a success or not, toregister them or not, which ones one should invest, I might have an interestingobservation here for you.

Domainindex was recently asked to perform a research among companies andorganizations for a customer on various domain related topics and one of thequestions was about the interest of companies and organizations in their .comdomain name (which they all did not own).

So we contactedcompanies and organizations operating with a ccTLD (in 11 different ccTLD´s) orgTLD (in 7 different gTLD´s).

We selected from alist of 3 Mio domains and reached out to about 17.000 companies andorganizations, we made 5500 calls with the owners or at least the person incharge for domain acquisitions (yes this was a big operation for us).

So these are the results:

In the ccTLD, all Ican say is that the interest was high in the .com names but there have been theusual reasons why they have never been able to get it (to expensive or anothercompany of the same name on it etc.)

The owners of domainsin .info,.biz,.co,.asia,.eu usually are very small businesses, they would likethe.com version of their domain name, however they are not even willing to paya few hundred dollars for their .com which usually would cost in the thousandsor 10,000, so far so good.

Amazingly it turns out the .net zone contains an incredible high number of verylow quality sites, I always had the feeling it's lower quality but afterevaluating the top 150,000.net domains by European and American traffic I mustsay we have been amazed with the extremely low number of quality sites under.net

Very different is the .org zone, first of all the quality of sites in generalis very high. The density of quality organizations and businesses among the top150,000 .org domains ranked by international traffic was higher than in anyother gTLD or ccTLD (besides .com). We found 25,000 reputableorganizations and businesses. What was really interesting is this: aftercalling about 500 from the top .org sites that do not own their .com domain itturns out that they are all perfectly happy with their .org domain name andhave no interest in the.com.

What that means to me is that those new gTLDs that really succeed to brandthemselves as something special, within a community or a particular kind of organizationhave great chances to become popular and successful up to a point where theircustomers might prefer the .org over the .com version. But it also shows thatthose that do not succeed will be populated with spam, porn and low-qualitysites.

New tools preview: Leadgeneration

What is going on with the 100 oldest Domains ?

Part of that work was to research the current status of the domains. This part we would like to share with you because it looks quite interesting:

From the 100 names registered between January 1, 1985 and November 30, 1987:

58 are now owned by a different entity from the one that registered it

35 are owned by Fortune 500 companies

7 are owned by pioneers of the web

Of the 100 oldest domains:

12 Do not resolve

4 are Parked

84 are in use

1 was subject to a UDRP (octopus.com)

These companies hold more than one of the oldest 100 domains:

3 Oracle

3 Verizon

2 Northrop Gruman

2 Intel

2 Siemens

2 AMD

2 Raytheon

These domains do not resolve or are not in use

unipress.com

grebyn.com

gmr.com

rdl.com

ub.com

gte.com

mentat.com

tti.com

kai.com

ray.com

kccs.com

nsc.com

These are parked

quad.com

ide.com

prime.com

mcc.com

These Domains look like being owned by domainers

symbolics.com

prime.com

datacube.com

spdcc.com

cayman.com

kccs.com

ide.com

octopus.com

mcc.com

ub.com

kesmai.com

These are active and belong to Fortune 500 companies or large entities

xerox.com

sri.com

data-io.com

hp.com

ibm.com

intel.com

ti.com

att.com

tek.com

fmc.com

ge.com

boeing.com

siemens.com

fluke.com

mentor.com

nec.com

adobe.com

cisco.com

amd.com

philips.com

dupont.com

lockheed.com

ncr.com

alcoa.com

ccur.com

convergent.com

unisys.com

cgi.com

apple.com

slb.com

utc.com

trw.com

gene.com

dsc.com

These domains still belong to pioneers of the WWW, the same people that regstered them

toad.com

tic.com

nma.com

entity.com

vortex.com

itcorp.com

These companies, that used to own the domains are out of business or merged

symbolics.com (symbolics inc.) bankrupted in 1995

think.com (thinking machines Corporation) bankrupted in 1994, the domain is owned by Oracle and redirects to their thinkquest sites

mcc.com((Microelectronics and Computer Consortium - MCC) dissolved i 2004, the domain is parked

grebyn.com (Grebyn Corporation) not in use anymore, but seems to be owned by the same company that registered it, the domain does not resolve

stargate.com ( online community of the early 1980s) dissolved in 1988, it points to latisys.com

rosetta.com (rosetta consulting) unknown when but went out of business, the domain is used by a new business today

datacube.com (Datacube Inc) went out of business in 2005) the domain now hosts a domain market

ksr.com (Kendall Square Research) KSR went out of business in February 1994, when their stock was delisted from the stock exchange, the domain belongs to a new company today

wlk.com (W.L. Kennedy Jr. & Associates) company cannot be found anymore, domain is owned now by westlake chemicals

kccs.com (KC Computer Sciences) seems to be out of business since the 90ies, domain does not resolve seems to be owned by a domainer

bbn.com BBN technologies was acquired in 2011 by Raytheon and points there

dec.com (Digital Equipment Corporation) aquired by compaq in 1998

northrop.com(Northrop Corporation) aquired grumman in 1994 and reformed under northropgrumman

bellcore.com (Bell Communications Research, Inc. or Bellcore) now belongs to Ericsson

sun.com (Sun Microsystems, Inc) in 2010 taken over by Oracle

ub.com (Ungermann-Bass, also known as UB and UB Networks) aquired in 1988 by Tandem Computers, not in use

bell-atl.com ( Bell Atlantic) merged with GTE in 2000 to form Verizon, the domain does not resolve

isc.com (Interactive Systems Corporation) sold to Eastman Kodak in 1988, the domain is now owned by a new company

nsc.com (National Semiconductor) sold to AMD in 2003, the domain is not in use

pyramid.com (Pyramid Technology Corporation) bought by Siemens in 1995, now it's used by a completely new company

portal.com (portal communications) was aquired by oracle in 2006, the domain forwards to oracle.com

ci.com (Cognition, Inc.) went out of business in the 90ies, the domain was bought by an investment firm

alphadc.com (probably used by Digital Equipment Corporation for the DEC Alpha Chip series) now used by a real estate company

bdm.com (Braddock, Dunn & McDonald) a military contracting company, in 1997 purchased by TRW and in turn aquired 2002 by Northrop Grumman

inmet.com (Intermetrics, Inc.) merged with Whitesmiths Ltd in 1988, after many more mergers its now owned by L-3 Communications

kesmai.com(Kesmai was a pioneering game developer and online game publisher, founded in 1981) aquired in 1994 by Murdochs News corp. and later by EA

3com.com (3Com Corporation ) 2010, Hewlett-Packard completed the acquisition of 3Com.

peregrine.com (Peregrine Systems, Inc) was aquired by HP in 2005, the domain is today used by an investment firm

dg.com (Data General) aquired by EMC in 1999, domain is owned by Dollargeneral.com today

cts.com (Crash TimeSharing) went out of business in the 90ies and the domain is now owned by a new company

ray.com (raytheon corporation) still belongs to raytheon but the domain does not resolve anymore

tandy.com (Tandy Corporation) aquired in 2000 by Radio Shack, domain redirects to Radioshack.com

spdcc.com (S.P. Dyer Computer Consulting), went out of business in the 90ies, today owned by a domainer

prime.com (Prime Computer, Inc) sold to Parametric Technology Corporation,domain now under under privacy

marble.com (Marble Associates) went out of business around 2004, the domain i snow used by a marble producing company

kai.com (Kuck and Associates, Inc.) aquired by Intel in 2000, the domain does not resolve and is owned by Intel

cayman.com 2001, Cayman Systems, Inc. was acquired by Netopia, Inc, today it redirects to offers for travel in the caymans

nynexst.com (NYNEX Corporation ) megred with Bell Atlantic in 1997, now Verizon

octopus.com (octopus enterprises) went out of business in 2005. The Domain was aquired by a domainer in 2006. In a UDRP 2011 the name was almost lost to a travel company but still is owned by the same person that bought it in 2006

tti.com(citigroup TTI) still belongs to citigroup but not used anymore, the domain does not resolve anymore

teltone.com (Teltone corporation ) was aquired by Industrial Defender in 2008, the domain still shows the teltone products

wyse.com (Wyse Technology) Wyse was aquired by Dell in 2012

spectra.com (spectragraphics) went out of business in 1998 and the domain is now used by a new company

allied.com (AlliedSignal) purchased Honeywell for $15 billion in 1999, and thereafter adopted the Honeywell name and identity, the domain belongs to a new company today

mentat.com (Mentat, Inc.) was acquired by Packeteer, Inc. on December 22, 2004, the domain does not resolve

gte.com (General Telephone & Electronics Corporation) Merged with Bell Antlantic then became part of Verizon, the domain is not used

quick.com (quicksilver engineering) went out of business, the domain is owned by a canadian beverage company today is not in use

sco.com (Santa Cruz Operation) merged with Tarantella Inc. in 2001 and later to UnXis Inc and redirects to xinuos.com

unipress.com (unipress software) unclear status. probably aquired by numarasoftware which now belongs to bmcsoftware

ide.com (Interactive Development Environments) stoped being operational in the late 90ies, domain now owned probably by a domainer

parcplace.com, the company was merged into several new companies and the domain is now owned bw cincomsmalltalk.com and redirects there

rdl.com (Research & Development Laboratories) the company is not active but whois still shows the same owner

sq.com (SoftQuad) in 2001 Corel bought most assets, in 2004 Just Systems bought the remaining assets. The domain now belongs to singaporeair.com

quad.com (Quadratron Systems Inc.) went out of business early 2000, the Domain owned by a domainer and parked

gmr.com(General Motors Research Laboratories) domain not in use anymore

rosemount.com(Rosemount Inc) a subsidiary of Emerson Electric Company, the domain forwards to emerson.com

amdahl.com (now owned by Fujitsu) the domain redirects to Fujitsu.com

das.com(earlier DA Systems Inc.) since 2000 the domain is owned by the German DAS insurance Group

Seasonal fluctuations in parking revenues

| January | 1.16 |

| February | 1.05 |

| March | 1.06 |

| April | 0.90 |

| May | 0.93 |

| June | 0.91 |

| July | 0.89 |

| August | 0.91 |

| September | 0.94 |

| October | 0.98 |

| November | 1.19 |

| December | 1.09 |

Project 94: .org 1 and 2 letter domains preappraised

The Public Interest Registry (PIR) will release 94 previously restricted domains to the public in a project called Project94. To take part in the auctions it is necessary to qualify or in the words of PIR: "the addresses will be made available through an allocation process to companies and organizations who respect the attributes .ORG has become known for – namely, trust and well-intentioned"

The auctions will be held through a partnership with Go Daddy and eNom.

It is currently unclear how restrictive PIR will be when it comes to accept bidders for the auctions of these 94 domains, therefore it is very difficult to estimate how far the actual price for the domains will reflect the proper market value.

We have preappraised the end-user prices for the names to provide orientation in the process. Few names are not part of this list because we have provided estimates for our customers earlier.

| 0.org | 75000 |

| 0d.org | 5500 |

| 0n.org | 4500 |

| 0p.org | 5500 |

| 0t.org | 8000 |

| 1.org | 125000 |

| 1w.org | 65000 |

| 2.org | 75000 |

| 2c.org | 12500 |

| 2w.org | 10000 |

| 3.org | 35000 |

| 31.org | 5500 |

| 3g.org | 25000 |

| 3p.org | 12000 |

| 4.org | 15000 |

| 5.org | 15000 |

| 57.org | 8000 |

| 5c.org | 8000 |

| 5v.org | 8000 |

| 6.org | 55000 |

| 6g.org | 8000 |

| 6j.org | 45000 |

| 7.org | 55000 |

| 75.org | 8000 |

| 7d.org | 8000 |

| 7e.org | 8000 |

| 8.org | 45000 |

| 9.org | 65000 |

| 9q.org | 35000 |

| a.org | 110000 |

| b.org | 100000 |

| b3.org | 35000 |

| bp.org | 35000 |

| c.org | 75000 |

| c2.org | 8000 |

| cq.org | 8500 |

| d.org | 45000 |

| d3.org | 8000 |

| e.org | 150000 |

| e3.org | 12500 |

| f.org | 78000 |

| fs.org | 9000 |

| g.org | 155000 |

| h.org | 120000 |

| h9.org | 8000 |

| hb.org | 20000 |

| i.org | 185000 |

| i6.org | 25000 |

| j.org | 40000 |

| k.org | 125000 |

| k4.org | 8000 |

| l.org | 35000 |

| lo.org | 10000 |

| m.org | 95000 |

| n.org | 90000 |

| nh.org | 8000 |

| nq.org | 8000 |

| o.org | 105000 |

| o7.org | 8000 |

| p.org | 98000 |

| pj.org | 8000 |

| q.org | 74000 |

| qd.org | 7800 |

| r.org | 75000 |

| r4.org | 7800 |

| s.org | 90000 |

| t.org | 90000 |

| ts.org | 15000 |

| u.org | 95000 |

| ur.org | 7800 |

| v.org | 75000 |

| w.org | 75000 |

| wz.org | 7800 |

| xq.org | 5500 |

| y.org | 140000 |

| yk.org | 7800 |

| yo.org | 40000 |

| z.org | 90000 |

| z8.org | 7800 |

| z9.org | 7800 |

| zg.org | 7800 |

| zi.org | 7800 |

| zl.org | 7800 |

| zp.org | 7800 |

| zq.org | 7800 |

Domainindex.com Downgrades Internet TLD .co.uk and Warns About co.uk and .uk TLD´s

Domainindex.com, the domainindustry's leading benchmarking, TLD analysis, rating and Domain appraisalservice, has announced today that it has changed its rating for .co.uk from AAto B

Domainindex.com, the domainindustry's leading internet domain name benchmarking, rating and appraisalservice, has announced today that it has changed its rating for .co.uk from AAto B. The step has been taken after the release on October 1, 2012 of a three-monthconsultation by Nominet, the not-for-profit manager of the .uk infrastructure,into a scheme that would introduce .uk as a top-level domain (TLD). Aftergetting feedback from Nominet meetings held in London on Nov.7and 9 Domainindex.comdecided to change the .uk rating

Currently, over ten million UKdomains are structured as www.anybusiness.co.uk; under the proposal, a competingstructure would be introduced: www.anybusiness.uk. Domainindex has also issued anInvestors Warning for co.uk and .uk TLD, and believes the introduction of the.uk TLD would massively destroy the value of existing .co.uk domains and infact Nominet´s announcement already inflicted harm to the value of .co.ukdomains and the aftermarket as well as the investment climate in the .uk TLD.Our analysis of the proposal, which Nominet defends as a move to increaseInternet Security, would have several adverse effects:

· The auction of .uk sites would preferentially favor trademarkholders instead of existing domain holders, thereby representing anunprecedented expropriation ofdomain registrants and website of whom most do not own the trademark for theirdomain name.

· The higher costs of the .uk TLD are in effect an Internet tax for businesses in the UKand especially to domainers as it will raise the cost of holding an inventoryby 800% and will lead to drop of many .co.uk names that until recently haverepresented significant value.

· The move will create more bureaucracyand red-tape.

· British companies would have massive rebranding costs.

· The proposal will create months or years of uncertainty as the issue is litigated in the courts.

We will closely monitor the progressof the Nominet consultation and may issue further rating changes accordingly.

Domainindex also announced thefollowing rating changes in November:

· .me up from A to AA(because of the good performance of the TLD)

· .eu down from AA to A(because we expect the TLD to suffer from nTLDs and weak economy in the Eurozone)

· .info down from AA to A(because we expect the TLD to suffer more from nTLDs)

· .mobi down from A to B(because we expect the TLD to suffer more from nTLDs)

· .tel down from AA to A(because we expect the TLD to suffer more from nTLDs)

Domainindex.com is a domain appraisaland benchmarking service. It provides automated and manual appraisal ofindividual domain names and portfolios. Domainindex also provides indices tothe domain industry, tracking the value of each TLD and benchmarking theholdings of large portfolio owners with respect to the markets. Additionally,Domainindex provides ratings for 60 TLDs, rating them by economic, legal andtechnical criteria. Domain ratings are used by large portfolio owners to judgetheir risk profiles and exposures in the various TLDs as well as by lenders todomain owners.

Domainindex Announces New TLD Tool

We acknowledgefrom the get-go that our lists are not perfect. For one thing, they contain manydomains that cannot be registered because of trademark policies or otherrestrictions. Nonetheless, the lists constitute a very powerful resource forthose who plan to register domain names in the new TLDs.

Complicating ourassessments are the uncertainties surrounding the new TLDs:

· It is too early to discern thequality of each new TLD.

· Reliable estimates of marketingbudgets for each new TLD are not available.

· There are differentregistration restrictions and general policies across the universe of registriescontrolling the new TLDs.

· We do not as yet have a pricingforecast for the different TLDs.

Given theseinherent uncertainties, we have adopted a strategy to form our appraisals basedon an arbitrary number of 100,000 domains in each of the new TLDs.

To provideaccess our compiled lists, Domainindex.comhas created a new TLD Tool , available below. The first ten TLD lists are open to the public;to access the rest, you’ll have to subscribe– it’ easy and only takes a minute.

Domainindex Tool Confirms Weakness ofDomain Sales in 2012

Domainindex.com has just released a new statistical tool to track domain sales. The tool indicates that 2012 has so far has been a very weak year for the sale of domains. This confirms anecdotal evidence regarding the falloff of published deal sizes, and point to 2012 as the worst year in domaining since 2006.

We believe there are three reasons explaining this year’s dismal performance:

1) New top-level domains (TLDs) have hurt demand and therefore prices are weak. The nTLDs are considered risky by potential buyers, who are sitting on millions in investment funds. The resulting price weakness has discouraged large domainers from offering great domains, as they wait for the market to eventually rebound.

2) The current utility of new domains is low compared to other investments. With funding tight, buying domains is not currently considered a requirement for planning a new venture.

3) Privacy issues have gained increased purchase this year. We have not published any of our deals of $10,000 or higher. Furthermore, we have been involved in domain bids of up to $1 million; all domains were sold yet none of the transactions were published. In addition to concerns over taxes, buyers realize that a domain that is sold in a published transaction is harder to resell at a substantial profit. In other words, publicity hurts flipping. This trend also existed last year, so it is valid to draw comparisons between the two years.

It looks like we will have to wait until 2013 or even 2014 to see the market bounce back. In our opinion, big gTLDs and ccTLDs will receive a boost independent of the success or failure of nTLDs:

If nTLDs succeed, the market will be perceived as generally strong and that will help sales of old TLDs.

If nTLDs fail, investors will simply return to old TLDs and ccTLDS.

Our reaction to the lisitng of the IDNX on Reuters and Bloomberg

Its great to see the domain industry to grow into the financial sector, something we are working on for many years now and we honestly congratulate IDNX to be included in Reuters and Bloomberg this is a big achievement.

However I want to share some of my concerns connected with this step I must say that from an investors perspective I am afraid the promotion of the IDNX might cause more harm then good.

There is in fact nothing wrong with the methodology of the IDNX itself, the problem is created by the set of data used for the calculation: Sedo´s sales data from 2006 to today. So the first and obvious argument against this is that the IDNX only looks at a very specific marketplace, it would be a little like creating an index for antiques by only looking at antiques sold on eBay.

Sedo has created a great marketplace, the best and biggest in the world for domains, however there are certain domains that are simply rarely or never traded via sedo, with a commission between 15 and 20%, an escrow fee 3x higher than escrow.com it attracts a very particular crowd that will purchase domains. It fits the names in the range of 100 to 10.000 usd and usually again to domainers or webmasters and rarely to "high end" endusers in this price range.

I have talked to many domainers last week and almost nobody has bought or sold any domain in a range over 20K ever on Sedo, but traded many below 10K on Sedo´s marketplace. So what happens is that domains are simply growing out of the Sedo market once they reach a certain value. Yes from time to time Sedo will broker a huge domain like sex.com, but most big deals are made without any of the marketplaces or brokers, most endusers will simply contact owners via the whois and so will most domainers and webmaster and lawyers acting on behalf of big buyers.

So Why does it matter ?

1) Over the longterm, the IDNX would suggest only a very little growth in value for domain names, for .com´s 20%, .net 20%,.mobi 15%, es 20%, so from an investors perspective domains would therefore represent a horrible Investment because this means only about 2% revenue/year but in fact what we look at is that Sedo has managed to keep their average sales price increase at inflation level.

2) What do we see in the IDNX ? We see what we see all over, if the economy is doing well and the consensus is bullish, people buy more, when the sentiment is bearish people buy less (in this case domains) and pay less for them on this particular market. This is the worst case for domains as an investment, because the main thing every professional investor will look at if it comes to alternative investments is the correlation to the market. If an alternative investment is correlated there is usually no point to invest in it because you are inheriting additional risk and reduced liquidity and if you can achieve the same goal by buying an established financial instrument you will simply buy an index.

These 2 issues will make it harder to promote domains as investment in the future because it will be benchmarked against the IDNX within the Reuters and Bloomberg systems (and all other systems using the data) from now on.

Domainindex.com Downgrades Internet TLD: .COM, .NET from AAA to AA

Domainindex.com, the domain industry's leading benchmarking, DNS analysis, rating and appraisal service, has announced today that it has changed its rating for the .com and the .net TLD from AAA to AA

SEATTLE, Mar 13, 2012 (BUSINESS WIRE) --Domainindex.com, the domain industry's leading internet domain name benchmarking, rating and appraisal service, has announced today that it has changed it rating for the .com and the .net TLD from AAA to AA. The step has been taken after the release of an official statement by U.S. authorities of its intent to continue seizing .com, .net, .cc, .tv and .name domains and forcibly redirecting .org (and probably .us) domains. Officially, over 750 domains have been seized in the last few months by the U.S. government, most of them from overseas registrars. The U.S. government claims that illegal activities take place on these domains. However, many of the domains seem to have been seized simply for linking to gambling sites or sites streaming sporting events on the web.

Domainindex.com considers these seizures a threat to any .com domain and the internet DNS in general, given the fact that seized domains can be resold for the benefit of the U.S. government even more. This increases the threat to any valuable domains within these TLDs. Therefore, we've had to rerate the TLD today and to lower its rating by two steps, from AAA to AA. While the technical infrastructure, business and economic environment still deserve the AAA level, the legal situation no longer supports this rating.

About 50 large portfolio owners consult Domainindex.com ratings for domain names portfolio risk management and investor reporting. Because .com is still the "king" of TLDs, we do not expect any changes in customer asset allocations. Nonetheless, the step has been taken to make clear that other ccTLDs are not affected and will keep their AAA levels. Note that no generic TLD currently has an AAA rating anymore.

We will watch closely how, in the future, the U.S. and other governments handle this issue. Hopefully, we will be able to upgrade .com again. However, we are pessimistic, as a change in this policy will require a substantial change in US politics and in the governance of TLDs.

Domainindex.com is a domain appraisal and benchmarking service. It provides automated and manual appraisal of individual domain names and portfolios. Domainindex also provides indices to the domain industry, tracking the value of each TLD and benchmarking the holdings of large portfolio owners with respect to the markets. Additionally, Domainindex provides ratings for 60 TLDs, rating them by economic, legal and technical criteria. Domain ratings are used by large portfolio owners to judge their risk profiles and exposures in the various TLDs.